Embedded finance platform Neem has been granted a Non-Banking Financing Company (NBFC) license from the Securities and Exchange Commission of Pakistan (SECP).

This takes the business one step further toward its mission of enabling the Financial Wellness of the underbanked in Pakistan. Neem will use this license to offer embedded lending solutions designed for specific industry segments including MSMEs.

Read also: Pakistan exports 120,000 locally manufactured mobile phones

“Lending is one of the key pillars in the Neem vision of providing Financial Wellness to underserved communities. By partnering with specialized lending infrastructure players we are able to bring to market meaningful and customized offerings. Our initial focus is on the MSME sector, airtime lending, and smartphone financing as principal use cases,” states Naeem Zamindar, co-founder at Neem.

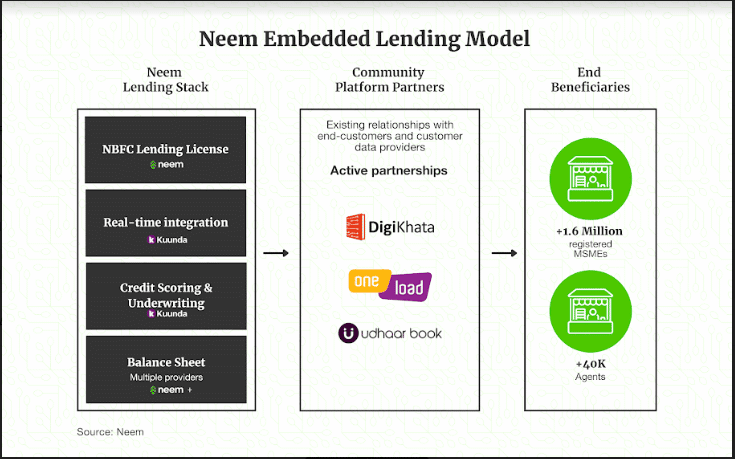

Many industries and customer segments suffer from a lack of access to meaningful working capital delivered on a real-time basis. Neem identified the underserved MSME sector as one of its primary segments of focus. It developed unique product offerings with its partner Kuunda Holdings, the second-largest liquidity solutions provider and credit analytics company in Africa.

Through this joint venture partnership, Neem will be able to finance karyana stores in Pakistan and be embedded into distribution partners like OneLoad, DigiKhata and Udhaar Book.

“In Pakistan, Kuunda and Neem are working jointly to address the needs of the underbanked. Today, Neem’s NBFC license, together with Kuunda’s scoring and loan management platform, is providing tailored growth financing products for retailers, micro-merchants, and agents across the country, ” says Jalal ul Haq, CEO of Kuunda Pakistan.

The combination of specialized technology infrastructure and embedded lending capabilities constructs an innovative approach for addressing the needs of underbanked communities in Pakistan and across wider emerging markets. Beyond the MSME sector, Neem is developing embedded lending products across airtime lending space and smartphone financing.

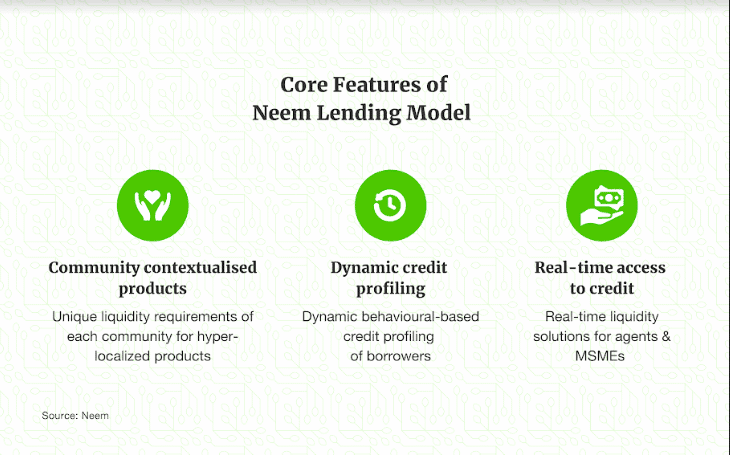

In all of those, dynamic credit profiling, data insights, and community-focused products are defining components of Neem’s embedded lending model.

Neem’s embedded finance and B2B2C (Business-to-Business-to-Consumer) market approach aims to transform lending from the point of service to the point of experience to serve consumers and MSMEs with contextualized lending products where and as they need them.

The lending platform is one of the 3 core embedded finance products provided and built by Neem. The Financial Wellness vision of enabling underbanked communities will be reached via API-enabled payment infrastructure, specialized lending and embedded finance marketplace.

Neem is an embedded finance platform enabling the Financial Wellness of underbanked communities – both individuals and businesses. They are seamlessly embedding financial products and services into communities across diverse sectors, including agriculture, MSMEs, e-commerce, fintech, logistics, healthcare, and others.

They’re starting from Pakistan and building for emerging markets, globally. Founded by experienced fintech entrepreneurs, operators, and ex-VCs.