The Pakistani Rupee (PKR) was stable against the US Dollar (USD) and halted losses during intraday trade today.

It held out and closed at Rs. 224.93 after quoting an intraday low of 225.250 against the greenback before close.

The local unit was initially bearish against the greenback and opened trade in the 224 range in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit dropped and stayed on the 224 level against the top foreign currency the interbank close.

Read also: Digitt+ Granted pilot launch approval in Pakistan

The rupee halted losses against the US Dollar today with informal rates still hovering around 254-265 against the greenback. Money changers said sentiments were bearish after markets opened today, despite SBP Governor Jameel Ahmed’s assurances that all pending letters of credit (LCs) will be cleared soon.

“I agree that businesses are facing numerous challenges, but until inflows improve, a certain level of stern management is needed. With time, all problems will be resolved in consultation with the business community and the Ministry of Commerce,” the governor stated.

Meanwhile, Pakistan’s current account deficit decreased by over 85 percent on a year-on-year (YoY) basis to clock in at $0.28 billion in November. While this shows how imports have reduced over the past few sessions, businessmen are of the view that exports have declined even further due to delays in the opening of LCs.

Rising political uncertainty has put off chances of economic stability any time soon as the country’s two major provinces are expected to dissolve assembles by Friday this week. While neutral participants are encouraging negotiations, consultations, and deliberations to achieve consensus on issues confronted by the nation and reduce political polarization, traders say consolidation is unlikely in the coming months.

Globally, oil prices rose on Monday after falling by more than $2 a barrel the previous session, as optimism about the Chinese economy outweighed concerns about a global recession. China, the world’s largest crude oil importer, is experiencing the first of three anticipated waves of COVID-19 cases after Beijing relaxed mobility restrictions but plans to increase economic support in 2023.

At 4:45 PM, Brent crude was up by $0.66 or 0.54 percent to reach $79.70 per barrel, while the US West Texas Intermediate (WTI) was also green at $74.78 per barrel. Both benchmarks fell 2% the day before as the dollar shored up and European central banks raised interest rates.

After Russia penetrated Ukraine earlier this year, oil reached a record high of $147 per barrel. Most of this year’s gains have since been reversed as supply concerns have been pushed aside by recession fears, which continue to weigh on prices.

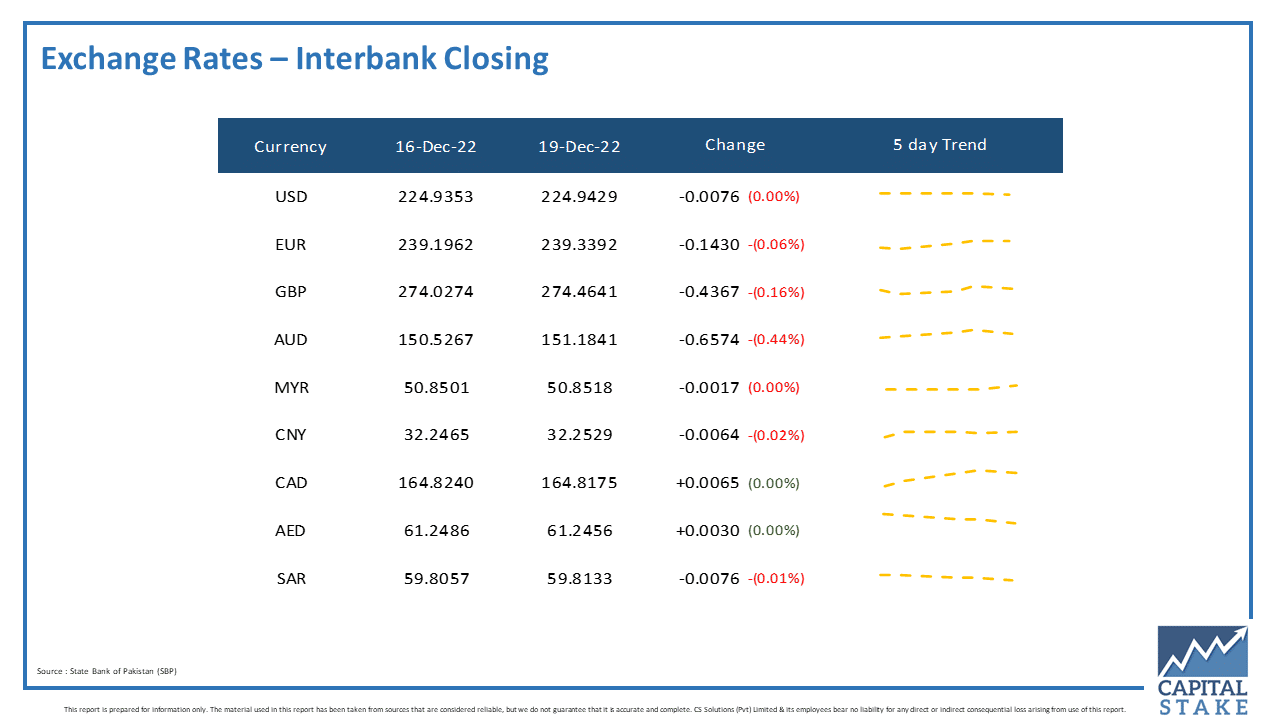

The PKR was bearish against most of the other major currencies in the interbank market today. It held out against the Saudi Riyal (SAR) and the UAE Dirham (AED) and lost 14 paisas against the Euro (EUR).

Moreover, it held out against the Canadian Dollar (CAD), lost 14 paisas against the Pound Sterling (GBP), and 65 paisas against the Australian Dollar (AUD) in today’s interbank currency market.